what is hospital indemnity high plan

While Medicare may cover some of this it wont cover the entire cost. Hospital indemnity insurance can also be referred to as hospital insurance.

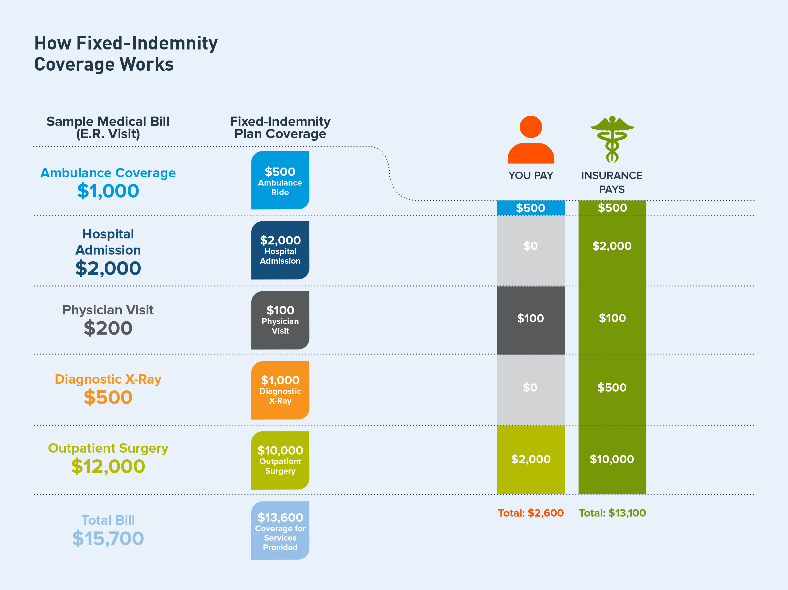

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

No matter which hospital you choose youll be covered.

. Hospital Indemnity insurance can help lower your costs if you have a hospital stay. Employees can use these benefits to help safeguard against expenses that medical insurance may not cover like co-pays deductibles or any other living expense that may arise. A Hospital Indemnity Insurance policy is flexible and can be tailored to your needs and budget.

Control your benefit costs. If you wanted to stay at the 616 budget you could select the 50 per month hospital indemnity insurance plan and purchase the Bronze plan. For example a 30-year-old individual with a 100-per-night hospital indemnity plan can expect to pay less than 5 per month to maintain coverage.

For example under Medicare Part A a patient must pay their. Hospital Indemnity insurance HI provides cash benefits for each day an employee or a dependent is confined in a hospital for a covered illness or injury. The amount of the benefit is based on the covered expenses and treatments covered by the employees plan.

Please feel free to call us at 866-966-9868 if you have questions about Hospital Indemnity Plans. Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. There are no networks copays deductibles or coinsurance restrictions.

The average price of a hospital stay for seniors is nearly 15000 for a five-day visit. Hospital indemnity insurance can help ease your stress about hospital bills so you can focus more on getting better. If you currently offer or are considering moving toward a high-deductible health plan Hospital Indemnity Insurance is a cost-effective way to round out your coverage options.

Essentially hospital indemnity insurance can help provide protection or assistance with expensive bills that can add up after a visit to the hospital. Our Hospital Indemnity Protection Plan is insurance that pays a lump-sum benefit directly to a covered employee after a hospital stay and related expenses. Every hospital indemnity insurance plan is different but Aflacs hospital insurance pays the.

This can be especially helpful if the major medical plans deductible has not been met. Premiums increase as policyholders age and add family members. The Aetna Hospital Indemnity Plan is a hospital confinement indemnity plan.

Any payment the plan makes is in addition to the benefits your employees receive from their health plan. Depending on the plan hospital indemnity insurance gives you cash payments to help you pay for the added expenses that may come while you recover. To apply just answer.

To learn more about hospital indemnity insurance and ask specific questions call 888-855-6837 to speak with a licensed agent. In short hospital indemnity insurance is coverage for a cash payout specifically in the event that you are hospitalized. The policy or its provisions may vary or be unavailable in some states.

Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays. What is Hospital Indemnity Insurance. Hospital indemnity insurance helps by putting recovery first over hospital bills.

Some plans offered by Health Benefits Connect can be purchased by a simple online application without medical underwriting. Complement a high-deductible health plan. The insurance company usually pays this daily benefit amount for up to a year.

Hospital Indemnity Insurance will pay. This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement. Peter Kuzniewski was born with a congenital hand deformity called bifid or duplicated thumb.

However you might not know what it means. 4 While health insurance pays for medical services after copays co-insurance and deductibles are met hospital indemnity insurance pays you if you are hospitalized. It also provides a 3000 lump sum outpatient surgical benefit.

Hospital indemnity insurance also known as hospital confinement insurance or simply hospital insurance is supplemental medical insurance coverage that pays benefits if you are hospitalized. This can be especially helpful if the major medical plans deductible has not been. Hospital Indemnity Insurance HI provides cash benefits for each day an employee is confined in a hospital for a covered illness or injury.

Monthly costs for individual hospital indemnity coverage for the young and healthy start at about the cost of buying a sandwich. Hospital Indemnity Insurance American Fidelity 2. Hospital Indemnity benefits are paid directly to the covered person regardless of other coverage and can be used for any purpose there are no restrictions.

What is hospital indemnity high plan Sunday March 13 2022 Edit. Hospital indemnity insurance is an insurance plan you can purchase in addition to your health insurance plan sponsored by your employer the government or a private insurer. Hospitals provide intensive support to those with an immediate medical needs.

Hospital Indemnity Insurance can help cover some out-of-pocket medical costs associated with a hospital stay. METLIFES HOSPITAL INDEMNITY INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY. Even with health insurance a trip to the hospital can be very pricey.

Also known as hospital confinement indemnity insurance or simply hospital insurance it is considered a type of supplemental health insurance. There is a hospital indemnity plan available for 50 per month which provides a lump sum hospital confinement of 6350. Hospital indemnity plans are especially beneficial for those with high deductible insurance plans.

If you are looking for extra financial protection against the unexpectedly high costs of hospitalization then a hospital indemnity plan may be worth considering especially if you have a high-deductible major medical plan. Hospital indemnity insurance is coverage you can add to your existing health insurance plan. The policy is not intended to be a substitute for medical coverage and certain states may require the insured to have medical coverage to enroll for the coverage.

The UnitedHealthcare Hospital Indemnity Protection Plan is insurance that pays a lump-sum benefit directly to a covered employee after a hospital stay and related expenses. A Hospital Indemnity plan can help ease the financial burden of a hospital stay whether it is planned or unexpected. Hospital Indemnity plans are typically paid for on a monthly basis.

Same-day appointments are available for patients who are in need of acute care.

What Is Hospital Indemnity Insurance Forbes Advisor

Why Group Hospital Indemnity Ppt Download

4 Facts You Need To Know About Hospital Indemnity Insurance

Insurance Securian Accident And Hospital Insurance

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Sun Life

Making Hospital Indemnity Part Of The Mix Guardian

Hospital Indemnity Insurance What You Need To Know

Hospital Indemnity Vs Accident Insurance Sbma Benefits

Why Hospital Indemnity Insurance Should Be Part Of Every Coverage Portfolio Allstate Benefits

Hospital Indemnity Insurance The Hartford

The Value Of Hospital Indemnity Insurance L Guardian

Medico How Hospital Indemnity Insurance Fills Medicare Advantage Gaps

Hospital Indemnity Insurance Chevron Human Resources

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

The Value Of Hospital Indemnity Insurance L Guardian